My Business Made Multiples In 2020 Despite Rookie Energy, A Global Economic Meltdown, And A Pandemic.

My business made multiples in 2020 despite rookie energy, a global economic meltdown, and a pandemic.

I'll take what are the positives for a thousand.

More Posts from Offworldertrading and Others

Fantastic day for gold and silver. Both outperformed US equity markets by a mile during the trading session. Both are still incredibly undervalued.

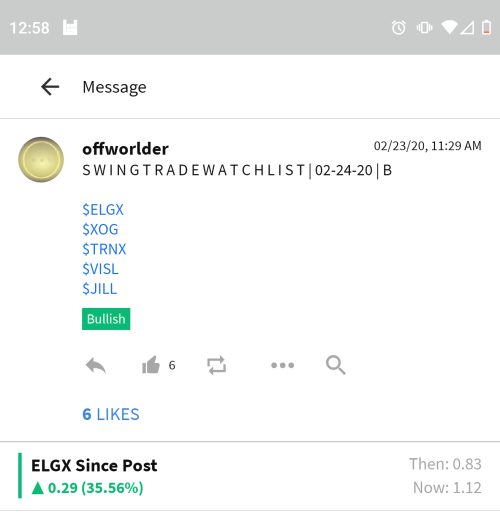

Today’s runner off of the microcap swing watchlist is ELGX. Moved over 38% near HOD.

Watchlists will be posted to Stocktwits!

Find me: @offworlder

OFF TOPIC

A vast majority of the tickers mentioned on this site pumped within 30 days. The proof is right here in your face.

Today is the last day I listen to small people trying desperately to tell me who I am and project their bad vibes in my direction.

I have no time to live in fear of action while building a business during a business apocalypse.

All this time...I forgot that I'm great.

HUSA was an early riser before it was faded midday. Made a move over 30% near HOD.

----------------------------

JOB moved 13% today.

Moon Talks! or: How I Learned to Stop Worrying and Chart the Uncharted

Now that the big ugly is finally revealing itself in the global economy/globally unified monetary policy, I feel it necessary to dive head first into all things DeFi - my true and everlasting first love. With the blessing of Paul Tudor Jones I'm proud to say...

BITCOIN! I've been actively investing in the crypto ecosystem since December 2016 when I purchased my first hardware wallet.

Brief digression: I clearly articulated why I believed the price of gold was going to pump and posted a chart crafted by someone else as a visual aid. Circle back to that...have you seen the price lately? 😎

This is the historical and projected trend-oriented price action of Ethereum expressed logarithmically with fibonacci retracement levels Russian doll stacked into the actual solar system. Why?

Because to me, the monthly chart looks like a giant bull flag being formed. I also think the market cap will explode over the next decade as adoption becomes commonplace. People will probably underestimate the effect of cross-chain liquidity projects.

Targets that will make bears die inside:

-A hold over 312 opens the door to rocket fuel at 552.

-A hold over 3428 opens the door to rocket fuel at 6115.

Possible 3 year wait. Possible 10 year wait. Deviation from this model entirely is very much "possible," but I believe 5 figures is endgame.

-Possible multi-year end of elliott wave 3 over +16k by fall 2023.

Should that day ever come to pass, rest assured OFFWORLDER will be immediately redomiciled in BVI as an incubator fund.

But shhhh...I'm not a doctor.

I don’t care what they say. I don’t care what you say. I know what’s in my heart. I know what I came to do. I know what I’m capable of. Speed bumps be damned, I stay the course.

Trust.

$FRM absolutely destroying. Smashed over 26% today. Snap taken near HOD.

TEAM #IRONHANDS

I understand the need for monetary policy based on sound/hard money. Gold and silver have had value since the beginning of human civilization. Gold is entropy resistant -- in terms of the physical properties of the element and it's capacity as a store of value. I also see money as energy. I believe the way man cooperates with fellow man (economic productivity) should be closer aligned with that which is thermodynamically sound. Why?

Because these are extraordinary times:

-Interest rates are the lowest they've ever been in 5000 years...

-A solid amount of the world is still ZIRP and NIRP.

-"Global" monetary policy warrants the use of fiat--a form of currency that has a proven track record of failure and replacement over a 1000 year timeframe.

-QE has significantly widened the divide in terms of socioeconomic stratification.

-The Lorenz Curve combined with the Gini Coefficient post-1971 are a strong indicator of fiat driven income inequality/currency instability.

-Free markets have morphed into unofficial central bank-managed markets.

-The largest asset bubbles in history are taking place right now.

-Zombie Corp Planet. That's it. That's the point.

-GLOBAL DEBT IS OUT OF THIS WORLD.

-Since the creation of the Fed in 1913, the purchasing power of the dollar has been significantly depleted.

-Fiat currency embraces monetary entropy and environmental degradation. Looks something like this:

-Fiat encourages spending rather than saving due to it's perpetual depreciation->leads to epic consumerism->leads to increase in garbage + pollution->environmental degradation

(fix the money to help fix the environment)

-Why fiat? A contributing factor is that those closest to the printing press can QUICKLY exchange fiat for an appreciating asset and grow their personal net worth. (Example: STOCKS)

😂🤣😂

-

metinengland liked this · 4 years ago

metinengland liked this · 4 years ago -

offworldertrading reblogged this · 4 years ago

offworldertrading reblogged this · 4 years ago